Synapse

Service

SynapseFI is a banking platform that enables companies to provide financial products to their customers for a fraction of the cost of traditional banks.

Responsibilities

- Defined and structured Synapse's information architecture, design, and user experience.

- Established and implemented creative and visual standards for Synapse's brand identity.

- Conducted extensive user testing to gather actionable feedback, analyze results, and identify areas for improvement.

- Leveraged user insights to refine the product strategy, enhancing functionality and usability based on feedback.

- Improved and proposed better information architecture from a UX design perspective.

- Empowered users with enhanced functionality, reduced support interactions, and designed an intuitive, user-friendly experience.

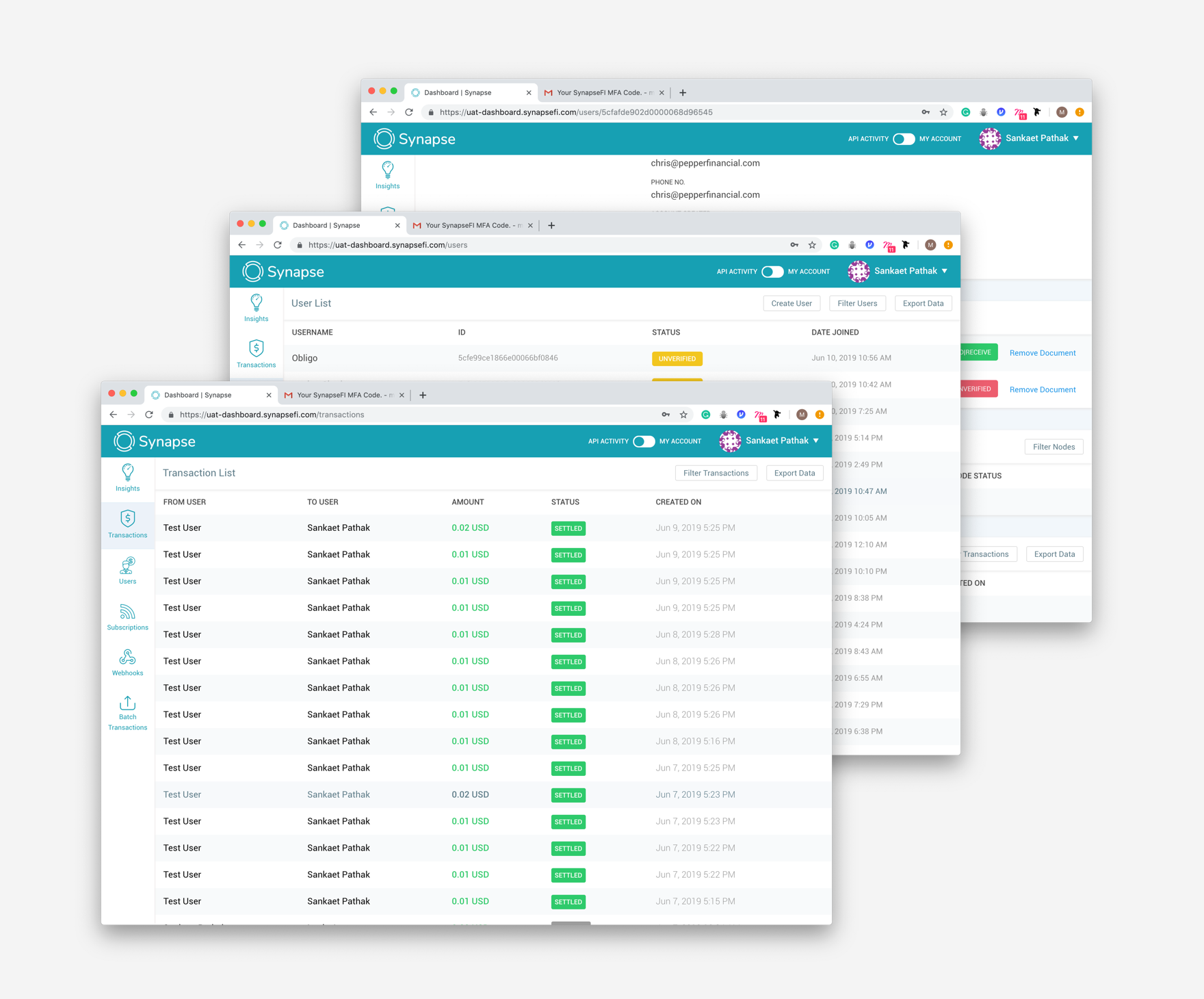

Client Dashboard : Before

Overall Problems

- Complex Navigation and Usability: The majority of participants reported that the development dashboard is challenging to navigate and use, frequently describing it as “confusing,” “unintuitive,” and “not user-friendly.”

- Hidden Key Functions: Many users expressed difficulty in locating important functions upon logging in, resulting in considerable time spent learning how to use the dashboard.

- Challenges for Infrequent Users: Users who access the dashboard infrequently struggle to understand available functionalities and capabilities.

- Inconsistent Functionality: Certain features, such as the “never log me out” button and batch transactions, do not operate as expected.

- Labeling and Language Issues: The dashboard suffers from poor labeling and unclear language, which hinders effective user interaction and understanding.

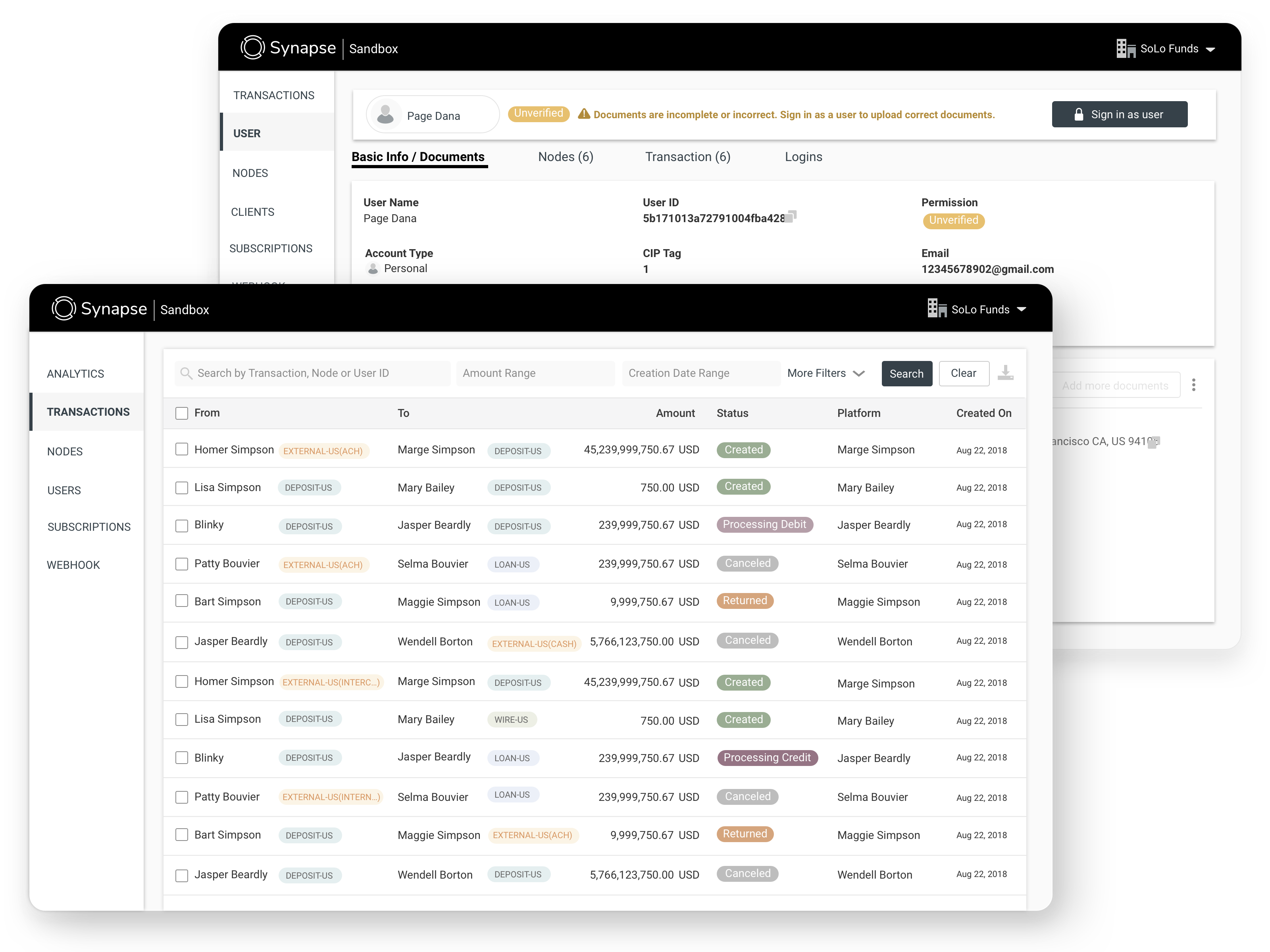

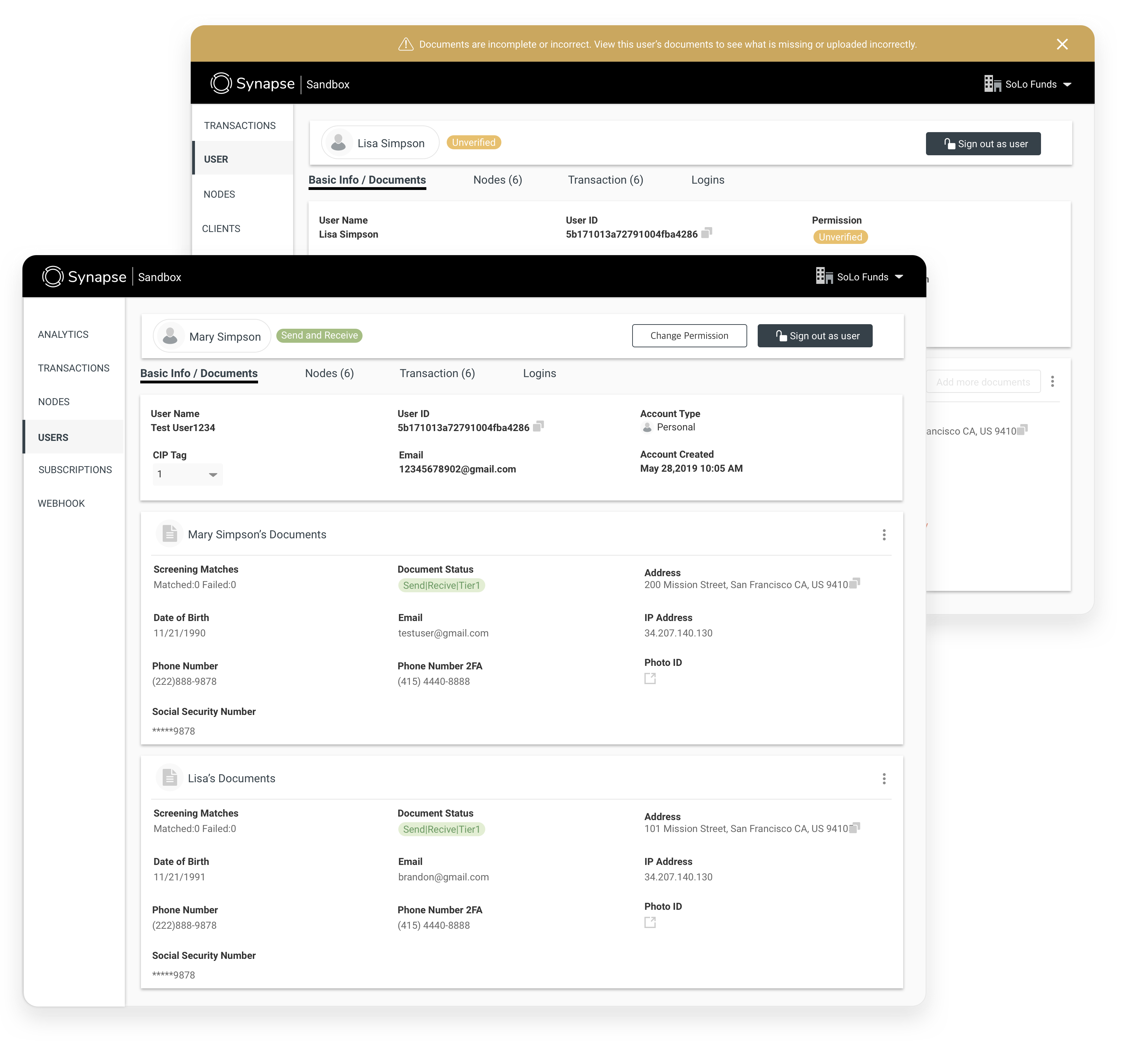

Client Dashboard : After

Improvements Direction

- Enhance User Autonomy: Empower users with greater functionality and the ability to complete tasks independently.

- Reduce Support Inquiries: Minimize the volume of help tickets and Slack messages received by improving self-service options.

- Improve Usability: Create a more intuitive and user-friendly experience to facilitate easier use.

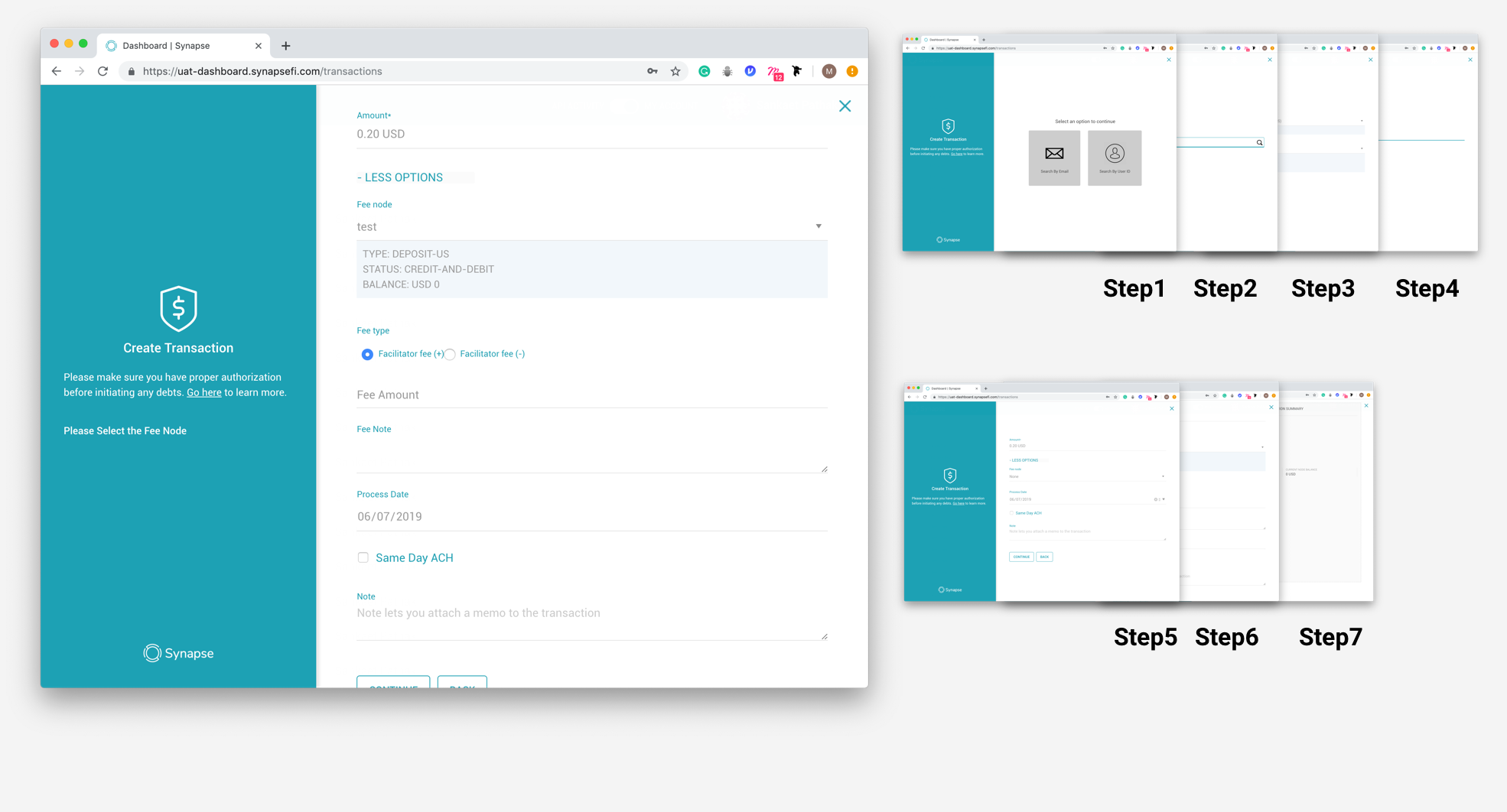

Create Transaction : Before

Overall Problems

- Complex and Lengthy Process: The current workflow is long and confusing for users.

- Unclear Fee Responsibility: It is difficult to determine who is responsible for covering the transaction fees.

- Uncertainty in Fee Amount: Users find it challenging to ascertain the exact transaction fee amount.

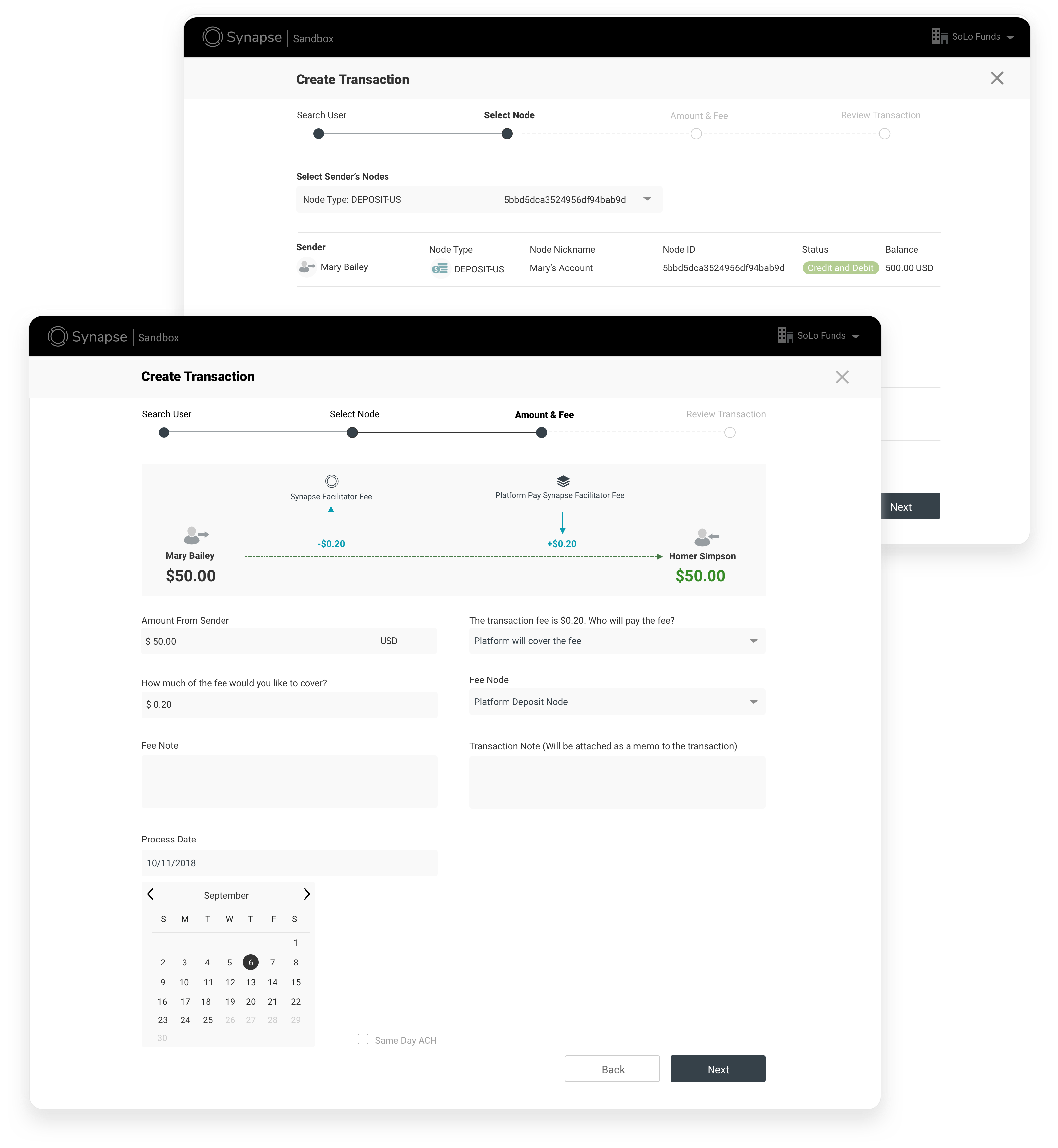

Create Transaction : After

Improvements Direction

- Simplify the Workflow: Streamline the process by reducing steps and incorporating clear, step-by-step guidance to enhance user understanding and ease of use.

- Transparent Fee Information: Implement a clear breakdown of transaction fees at the point of transaction, showing who is responsible for the fees.

- Real-Time Fee Calculation: Provide real-time calculations of fees before the transaction is completed to eliminate uncertainty and improve transparency.

- Intuitive Design Enhancements: Use visual aids and clear labeling to make the interface more intuitive, helping users navigate the process more easily.

- Interactive Help Features: Integrate tooltips, FAQs, and live support options to assist users throughout the transaction process, reducing confusion and support inquiries.

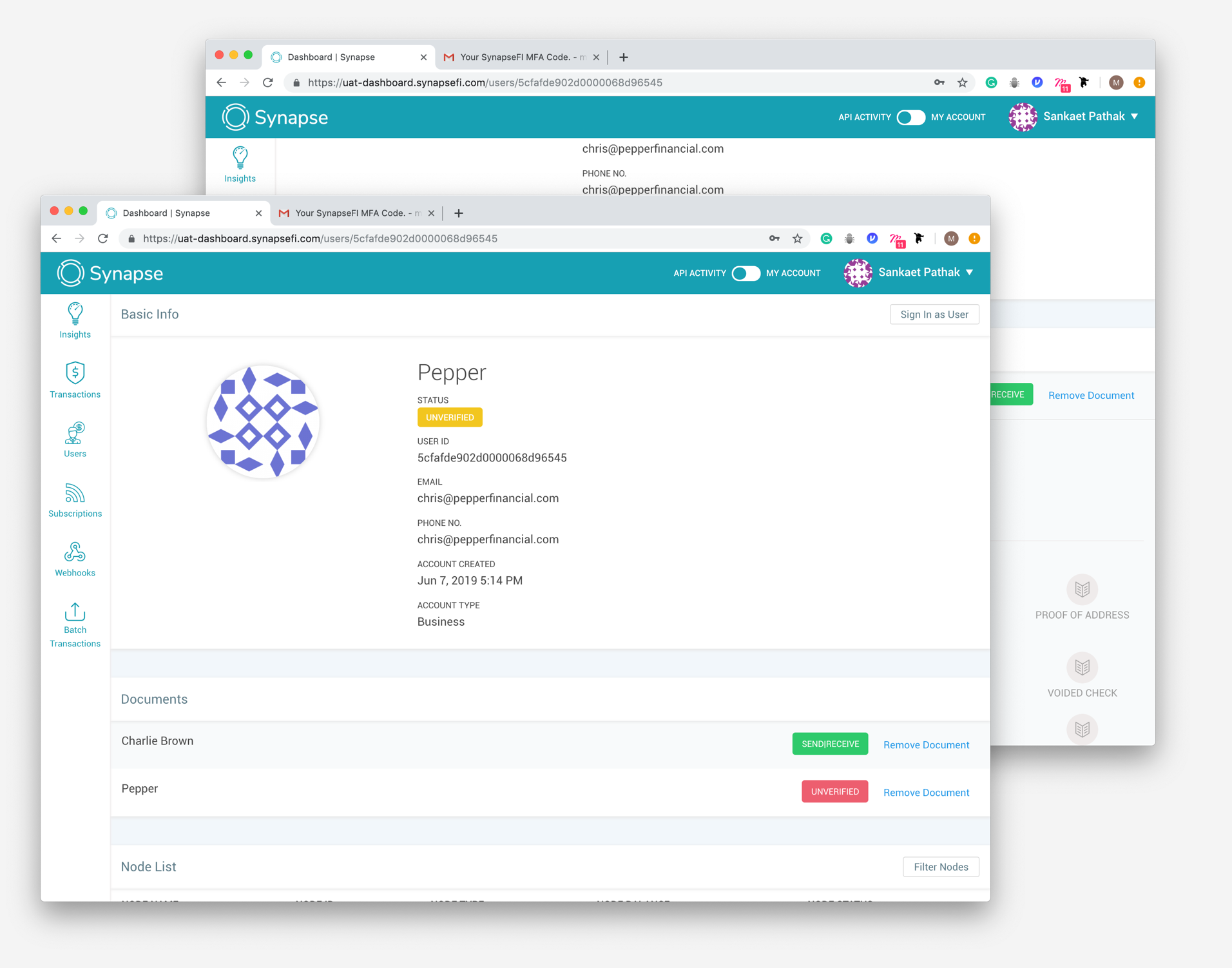

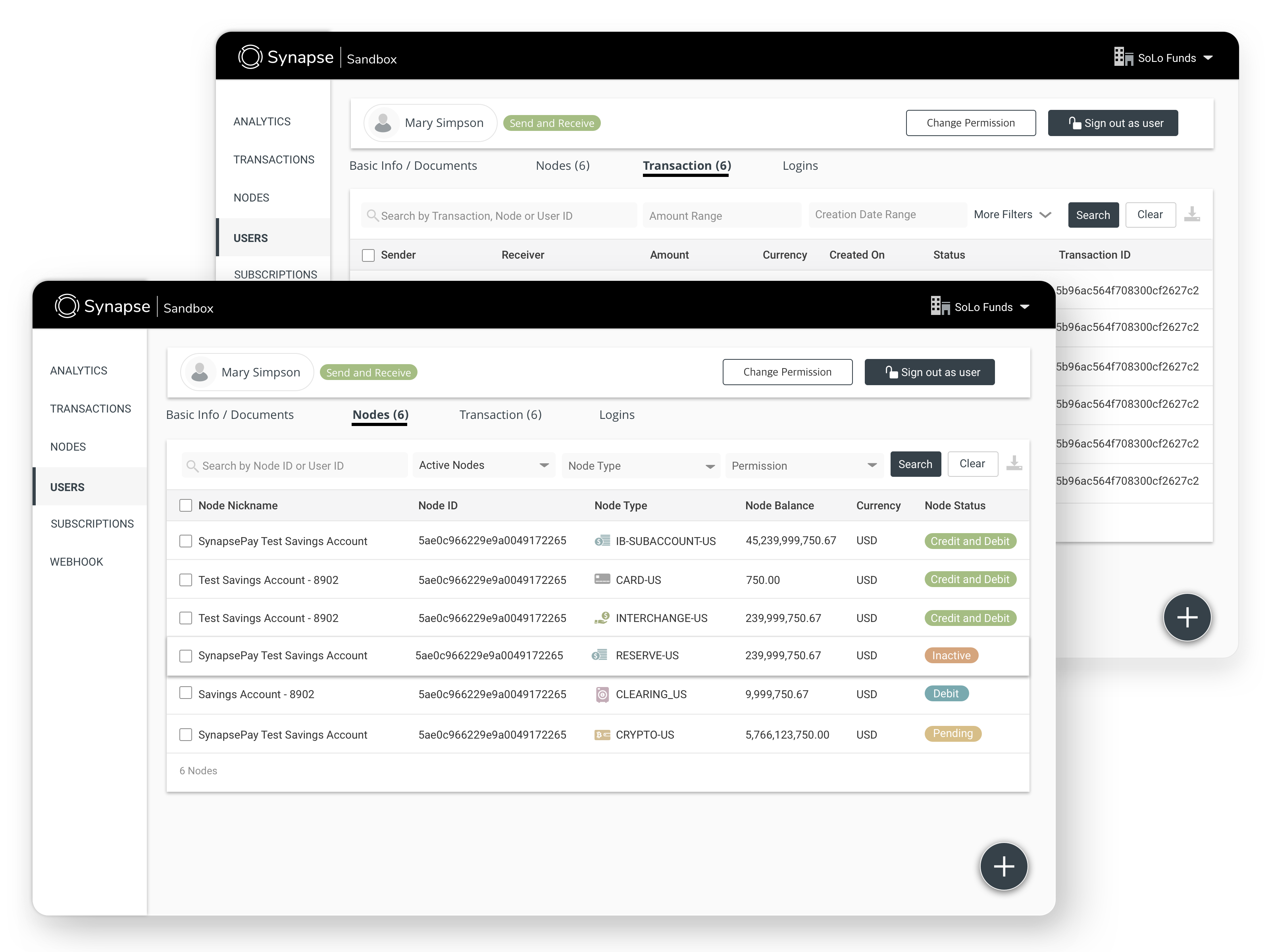

Dashboard-User Detail : Before

Overall Problems

- User Node Visibility: Users must scroll extensively to locate their node, making it difficult to identify at a glance.

- KYC Issue Identification: Users struggle to identify which KYC (Know Your Customer) requirements are missing and lack clear guidance on resolving these issues.

- Confusing Verification Indicators: The green and red circles used to indicate document verification status can be confusing, especially when documents are verified but not required for KYC.

- Document Verification Clarity: Users find it challenging to determine which documents are not verified and the reasons for their non-verification.

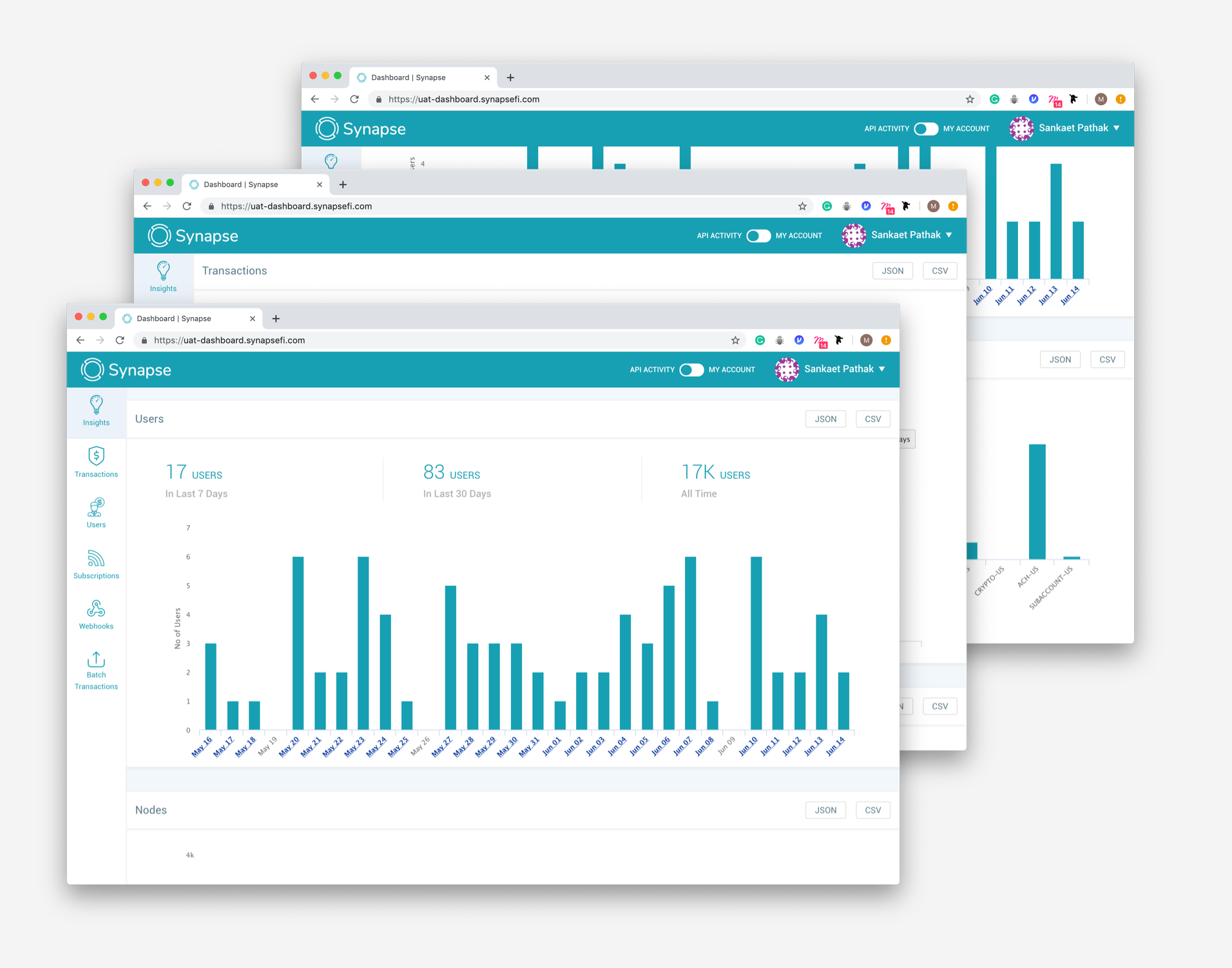

Analytics : Before

Overall Problems

- API Request Response Times: Complicated information architecture for API usage.

- Node Balances: Indirect access and visualization of node balance information.

- Transaction Volume Analysis: Insufficient data on transaction volumes, particularly for long-term trends beyond the past 30 days.

- User Verification Status: Unclear distinction between verified and unverified users.

Analytics : After

Improvements Direction

- Simplify the information architecture for API usage by organizing and categorizing API calls more intuitively.

- Design a more direct and user-friendly interface for accessing and visualizing node balance information.

- Enhance data visualization tools to provide comprehensive insights into transaction volumes, including long-term trends.

- Improve the user interface to clearly differentiate between verified and unverified users through distinct visual indicators.

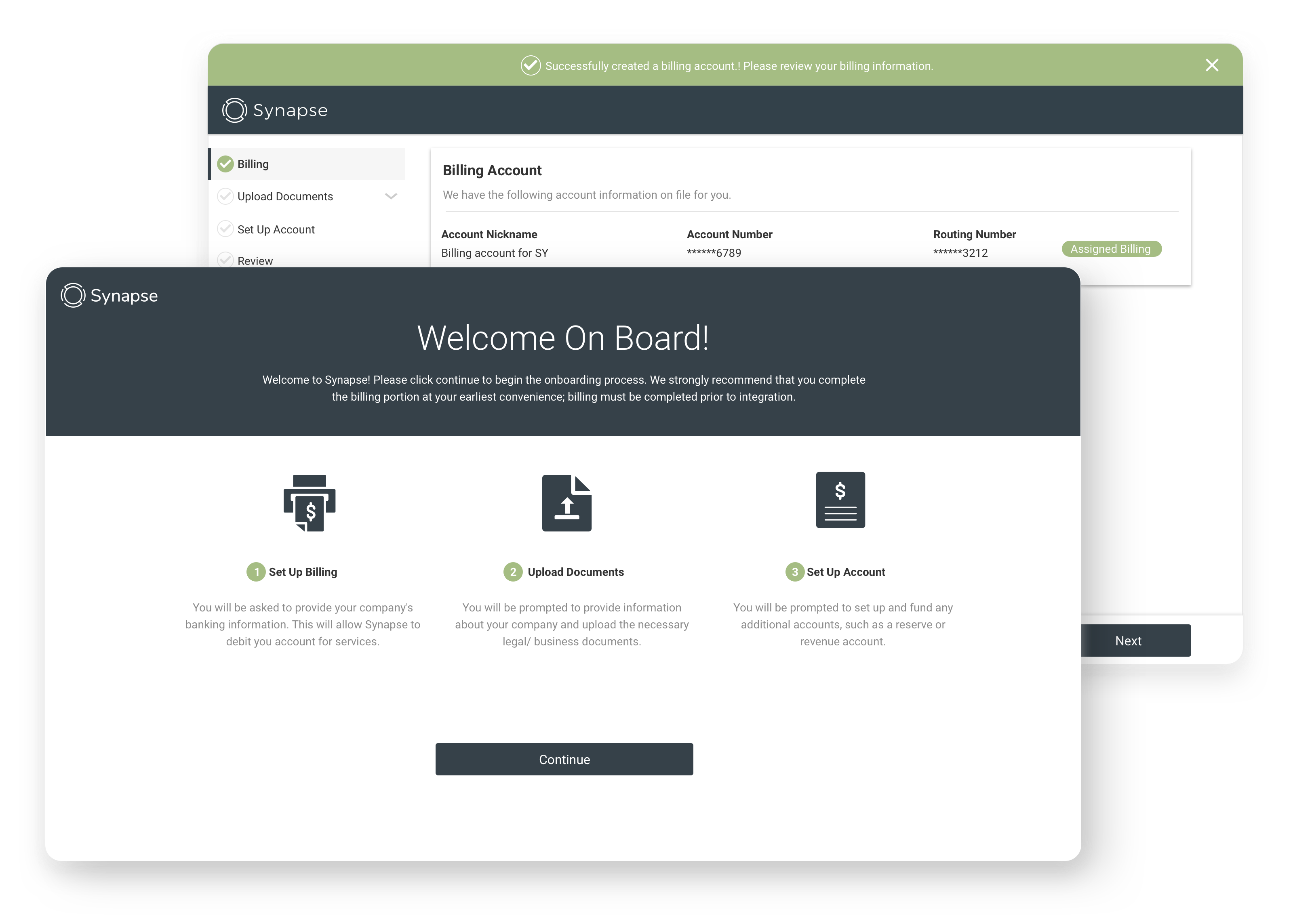

New Client Onboarding : New Feature

UX Directions

- Empower User Autonomy: Enhance user functionality to enable more self-service capabilities.

- Minimize Support Interactions: Implement solutions to decrease help tickets and Slack inquiries.

- Enhance Usability: Design an intuitive and user-friendly experience.